PCR Autotrender for Nifty 50 calculates the Put-call ratio and presents it in a minute-by-minute real time updating PCR table. The PCR table also includes VWAP and current Futures price of Nifty 50 to help traders make well-informed trading decisions while accessing live PCR data.

Option trading can be a very profitable business if done using the correct tools and discipline. One such tool is PCR Autotrender which calculates the PUT-CALL ratio and tries to predict a general direction that the asset class is headed towards. Hence it is most effective for NSE indices, particularly, NIFTY 50 and Bank Nifty. For Nifty 50, we present:

- Nifty 50 OI table

- Nifty 50 PCR table

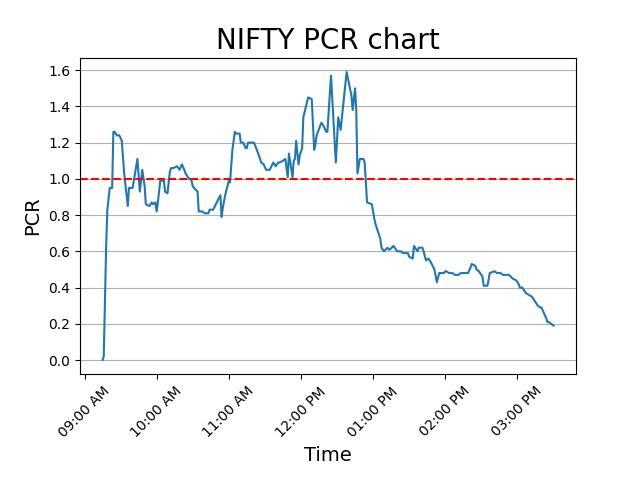

- Nifty 50 PCR chart

For calculation of PCR, we start by looking at the NSE Option chain. For Nifty 50, we consider the current strike price which is closest to the current spot price [at the money], and 16 of its nearest strike prices. We believe that strikes beyond these points are irrelevant in the calculation of PCR and often leads to confusion in decision-making. Below is the Nifty 50 Open Interest table:

NIFTY OI TABLE

Once relevant strikes are identified in the NSE Option chain, we calculate the Put call ratio (PCR) using the “Change in Open Interest” column. Based on our understanding, PCR calculated this way tracks the short term position taken by big market players more correctly and is more accurate for taking intraday trades in Options.

The PCR number generated for the current time is added to the PCR table below. Along with the PCR data, we include the VWAP and Nifty Futures current price. This data is maintained live during market hours and traders can see the movement of PCR along with VWAP and Futures from start of day.

Based on our opinion, if the PCR is above 1 and current Futures price is above the VWAP, that is a good signal to buy call options. However, since options trading is inherently risky, a prudent stop loss has to be maintained at all times. Best stop loss in our opinion is below the VWAP if you have bought the call options. A good strategy is to buy calls when PCR is above 1 and futures price is just above VWAP. This gives a good margin of safety. You can decide how much below the VWAP you want to place the stop loss depending on your risk-reward ratio.

Below is the live PCR Table for Nifty 50 which is updated minute-by-minute during market hours.

NIFTY PCR TABLE

| Time | Call | Put | PCR | Option Signal | VWAP | Nifty FUT | VWAP Signal | Action |

|---|

We recommend that you always maintain financial prudence while trading and trade with only the amount that you have earmarked as Capital.

It is generally a bad practice to trade in options or any asset class with borrowed money. With easy availability of bank loans and credit cards, it is very tempting to borrow some money and trade for a quick return. But as experience suggests, it is not a wise thing to do and often ends in poor results. Often big traders indulge in leveraged trades, but they are backed by almost endless credit lines and have huge sustaining power unlike most retail traders.

Below is the PCR Chart for Nifty 50:

NIFTY PCR CHART